CompositesWorld: The markets. Pressure vessels (2022)

Composites end markets: Pressure vessels (2022)

Global goals to reach zero emissions by 2050 drive high growth in composite pressure vessels.

#airbus#sourcebook

CNG, RNG and H2 fuel systems are increasingly used in passenger cars, buses, trucks and other vehicles or for bulk transportation — also called mobile pipeline — to supply refueling stations or industrial sites. In vehicles, these fuel storage tanks are a key component in reduced- or zero-emission powertrains for clean alternatives to gasoline, diesel and jet fuel. These powertrains also provide a chargeless alternative to battery-powered vehicles with refueling infrastructure and refill times that are similar to fossil fuels.

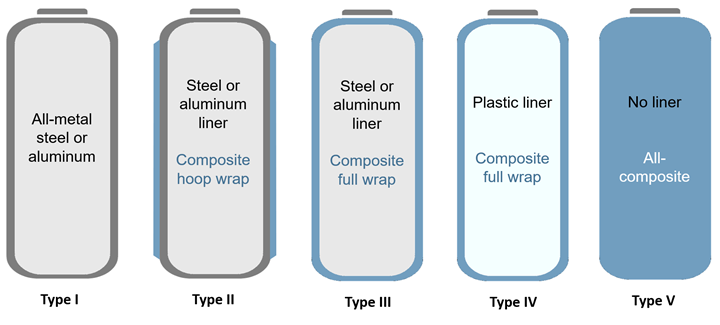

Pressure vessel types

Pressure vessel types and construction as classified by the American Society of Mechanical Engineers (ASME) and the International Organization for Standardization (ISO). Photo Credit: CW

Pressure vessels are organized into five types:

- Type I: All-metal construction, generally steel.

- Type II: Mostly metal with some fiber overwrap in the hoop direction, mostly steel or aluminum with a glass fiber composite; the metal vessel and composite materials share about equal structural loading.

- Type III: Metal liner with full composite overwrap, generally aluminum, with a carbon fiber composite; the composite materials carry the structural loads.

- Type IV: An all-composite construction, polymer — typically polyamide (PA) or high-density polyethylene (HDPE) liner with carbon fiber or hybrid carbon/glass fiber composite; the composite materials carry all the structural loads.

- Type V: Linerless, all-composite construction.

Historically, Type 1 has held more than 90% of the market. However, that is beginning to change, with increased sales of Type III and Type IV vessels that use composites to reduce weight and increase compressed gas storage efficiency. Type V is still nascent and mostly used in space applications, but is a sector to watch as the New Space industry develops. For example, in April 2020, Infinite Composites Technologies (ICT, Tulsa, Okla., U.S.) developed a spherical, Type V cryotank for the storing of cryogenic liquid propellants on rocket-powered space launch vehicles. The linerless carbon fiber/epoxy Cryosphere is manufactured via filament winding and industrial oven cure.

Market drivers and growth

The overwhelming driver in this market is growing global commitment to reduce the impacts of climate change by switching away from fossil fuels to renewable, reduced-emission fuels (e.g., CNG, RNG and H2), aiming for zero emissions by 2050. According to the International Energy Agency:

“Climate pledges by governments to date — even if fully achieved — would fall well short of what is required to bring global energy-related carbon dioxide (CO2) emissions to net zero by 2050 and give the world an even chance of limiting the global temperature rise to 1.5°C, according to the new report, “Net Zero by 2050: a Roadmap for the Global Energy Sector.”

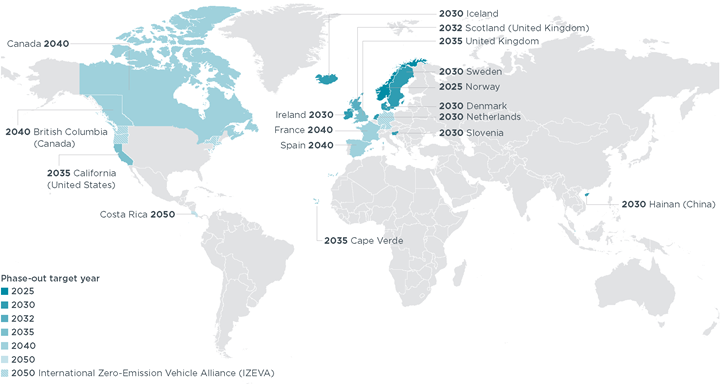

Governments with published targets for phasing out new sales of internal combustion engine (ICE) passenger cars. Photo Credit: The International Council on Clean Transportation (ICCT), Nov 2020 report

Note, that in addition to the commitments shown above, the U.S. states of Connecticut, Maryland, Massachusetts, New Jersey, New York, Oregon, Rhode Island, Vermont and Washington have committed to no new fossil fuel passenger cars by 2050, and these states, plus California, Colorado, Hawaii, Maine, North Carolina, Oregon, Pennsylvania and the District of Columbia will prohibit new fossil fuel medium- and heavy-duty vehicle sales as of 2050.

Another indication of growth was reported in the 2021 feature, “Hydrogen is poised to fuel composites growth, Part 1,” namely that Cummins (Columbus, Ind., U.S.), which produces 130 million internal combustion engines (ICEs) per year, many for buses, medium and heavy-duty trucks, has invested in development of a fuel cell Class 8 truck and a hydrogen combustion engine. In June 2021, Cummins indicated that such offerings will approach the total cost of ownership (TCO) of a diesel engine by the end of this decade, and that future heavy-duty transport will be powered by hydrogen, fuel cell or battery electric — not diesel.

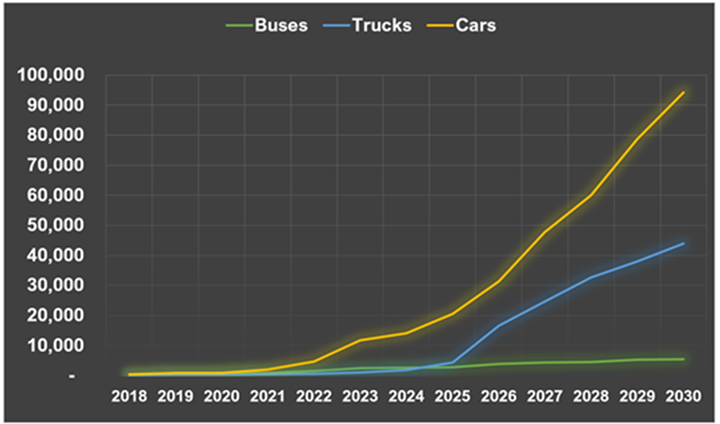

Carbon fiber in FCV tanks

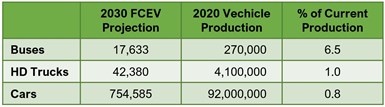

The graph shows projected carbon fiber usage (metric tons) in Type IV 700-bar compressed H2 gas tanks for the highest production volume fuel cell vehicles (FCV). The table shows that these 2030 projections are conservative. For example, less than 1% of current car production will be FCV in 2030. Photo Credit: Mike Favaloro, Ginger Gardiner

Alternatively, myself and industry consultant Mike Favaloro have projected that carbon fiber demand in hydrogen storage tanks alone will reach 166,650 MT by 2030, based on global new hydrogen vehicle announcements and an estimated 62-72 kilograms of carbon fiber per 700 bar/5.6-kilogram H2 tank at 60% fiber content. These vehicle projections are conservative, as shown in the table above, with only 1% of heavy-duty trucks, less than 10% of buses and less than 1% of cars projected to use hydrogen.

Source: CompositesWorld